A clear guide to understanding Cash Loans and their advantages

Understanding the Different Types of Car Loans Offered for Every Demand

Comprehending the different kinds of fundings is crucial for anyone steering monetary choices. Each finance kind serves a special objective and comes with its own set of problems and terms. Individual financings supply flexibility, while home loans assist in own a home. Auto and pupil fundings deal with certain acquisitions and investments. Alternatives like payday fundings can lead to economic pitfalls if not taken care of intelligently. The nuances of these fundings necessitate a closer evaluation.

Individual Fundings: Flexibility for Your Economic Demands

How can personal car loans act as a functional financial device? Individual car loans provide individuals with a flexible methods to address various economic demands. Unlike specific car loans such as vehicle or home mortgage, individual financings can be made use of for a large range of objectives, including financial debt loan consolidation, medical costs, or moneying a major purchase. This adaptability makes them particularly appealing.

Usually unsafe, individual fundings do not need security, making them available to lots of borrowers. Lenders examine credit reliability via credit report and income, allowing individuals with varied financial backgrounds to qualify.

Additionally, individual fundings commonly include fixed passion prices and predictable monthly payments, assisting customers in budgeting efficiently. With repayment terms varying from a few months to a number of years, these lendings use alternatives that can align with individual financial situations. As a result, individual lendings attract attention as a sensible selection for those looking for monetary versatility and immediate help.

Mortgages: Financing Your Dream Home

Home loans work as an essential monetary tool for people desiring buy their dream homes. These lendings enable purchasers to fund a significant portion of the property's cost, permitting them to spread settlements over an extensive period, typically 15 to thirty years. Home loans can be found in various forms, consisting of adjustable-rate and fixed-rate options, satisfying various economic situations and preferences.

Fixed-rate home mortgages use stability with constant month-to-month payments, while adjustable-rate mortgages may provide lower preliminary rates however lug the danger of future changes. Additionally, government-backed fundings, such as FHA and VA finances, help those with lower credit history or military service histories in protecting funding.

Potential property owners must extensively examine their economic scenario, thinking about elements like down payments, passion prices, and finance terms, to make educated decisions (Fast Cash). Inevitably, a home loan can transform the desire for homeownership right into truth, making it a vital consideration for lots of people and households

Automobile Fundings: Driving Your Desires

For numerous individuals, possessing a vehicle is as essential as owning a home. Automobile fundings work as a crucial funds for those aiming to acquire a cars and truck, whether it be for travelling, family requirements, or personal pleasure. Usually provided by financial institutions, cooperative credit union, and dealers, these fundings allow debtors to finance their automobile over a set term, generally varying from three to seven years.

Rate of interest may vary based upon creditworthiness, car loan term, and the kind of vehicle being funded. Consumers can select between pre-owned and new auto loan, each including distinct benefits and factors to consider. It is important for potential customers to analyze their spending plan, regular monthly payments, and total lending costs prior to devoting. Ultimately, vehicle fundings can help people drive their desires, making vehicle possession convenient and obtainable for several.

Pupil Financings: Spending in Your Education

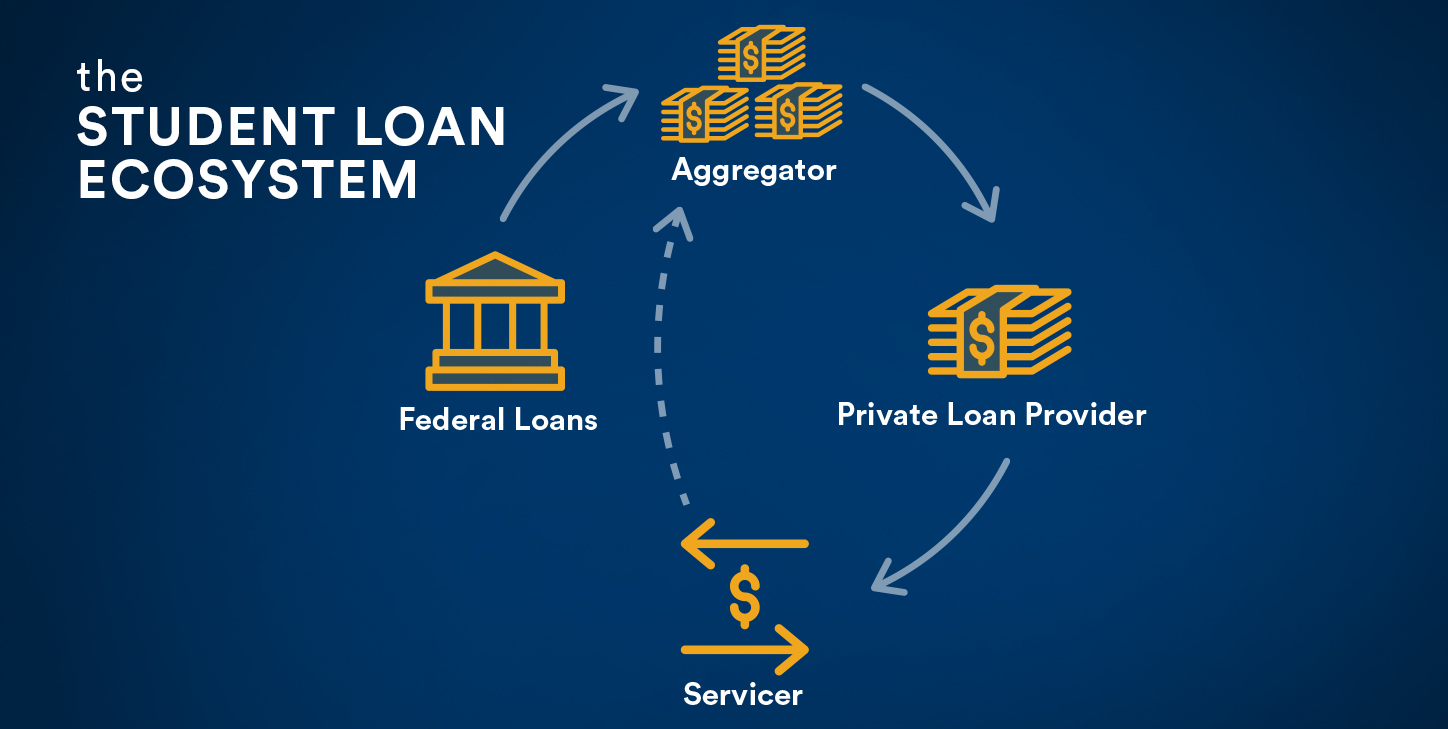

Pupil finances are a crucial monetary tool for countless individuals seeking to further their education and enhance occupation opportunities. These car loans give the necessary financing for tuition, fees, and living costs, permitting students to concentrate on their studies without the instant problem of economic stress. Offered in different kinds, such as private and federal fundings, they deal with various requirements and financial scenarios.

Federal trainee lendings commonly use reduced rate of interest and flexible repayment choices, making them a preferred choice. On the other hand, personal car loans may have varying problems and terms, typically calling for a credit scores check and a co-signer. It is vital for borrowers to understand the ramifications of pupil financial obligation, including payment timelines and find out interest prices, to avoid financial mistakes post-graduation. Purchasing education with pupil financings can produce considerable lasting advantages, leading the way for enhanced work prospects and greater making possible in the competitive job market.

Payday Loans: Quick Cash Solutions

Exactly how can individuals promptly gain access to money in times of economic demand? Payday loans act as a rapid remedy for those encountering unanticipated expenses. These temporary finances, typically for small amounts, are developed to connect the space up until the borrower's following income. Individuals can look for payday advance online or in-store, often getting approval within minutes.

The application process is straightforward, requiring marginal paperwork and no considerable credit checks, making them obtainable to a large range official site of consumers. Cash advance car loans come with high-interest prices and costs, which can lead to a cycle of debt if not handled properly. Customers need to be careful and totally understand the terms prior to proceeding. While payday advance loan can provide immediate alleviation, they must be considered a last resource due to their prospective financial implications. Ultimately, individuals should weigh the benefits and dangers very carefully when opting for this quick cash money remedy.

Frequently Asked Inquiries

What Variables Impact My Funding Qualification and Rate Of Interest?

Car loan qualification and rate of interest are affected by aspects such as credit history, income level, debt-to-income ratio, employment background, funding quantity, and the particular loan provider's requirements. These components figure out the danger perceived by lenders.

Exactly How Can I Improve My Credit Report Prior To Requesting a Funding?

To improve credit ratings, people ought to pay costs on time, lower impressive debts, prevent brand-new credit questions, and routinely inspect credit records for mistakes. Regular positive financial habits can bring about enhanced credit reliability prior to lending applications.

What Records Are Needed When Obtaining a Financing?

When getting a funding, people generally require to supply identification, proof of revenue, credit report, employment verification, and information of existing financial obligations. Additional papers may vary depending on the loan provider and finance type.

Can I Re-finance My Loan Later On for Better Terms?

Yes, re-financing a finance for far better terms is feasible. Customers typically seek this alternative to reduce rates of interest or readjust payment schedules, possibly leading to substantial financial savings and boosted economic flexibility with time.

What Should I Do if I Can Not Settle My Finance promptly?

If unable to pay off a car loan on schedule, the person ought to communicate with see this the lending institution, explore possible settlement alternatives, think about funding restructuring, or seek economic therapy to prevent additional problems and possible damages to credit report.

Personal lendings supply individuals with an adaptable means to address various financial requirements. Unlike particular financings such as automobile or home financings, individual lendings can be utilized for a broad array of functions, consisting of debt loan consolidation, clinical costs, or moneying a significant purchase. With repayment terms varying from a couple of months to numerous years, these fundings use alternatives that can line up with individual monetary circumstances - Installment Loans. Trainee finances are an important monetary device for countless individuals looking for to enhance their education and learning and improve profession chances. Financing qualification and passion rates are influenced by elements such as credit report score, income level, debt-to-income ratio, employment background, car loan quantity, and the specific lending institution's standards